Market Segmentation in Germany as a Key Success Factor for Market Entry

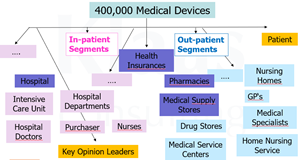

July 2021 – Market Segmentation in Germany – According to the Federal Ministry of Health, there are about 400,000 different medical devices in Germany. These are diagnostic devices, products for surgery, intensive care, implants, products for sterilisation but also covers and medical aids of various kinds or surgical materials and laboratory diagnostics, and many more.

These products are found in different market segments – for consumption/use, for sale/rental, for recommendation/prescription. Market segmentation in Germany depends heavily on product positioning. This can be completely different from the competitors; the manufacturer can even use this to differentiate itself from its competitors.

For example, a manufacturer in the diabetes sector would classically concentrate on the customer group of diabetologists as prescribers of the test strips and on the segment of pharmacists for the sale of the test strips. Through a different product positioning, e.g. free sale of the test strips and devices, the drugstores or even the supermarkets would be in the foreground as a customer group for sales.

Consequently, this also raises the question: Which market segments are there in Germany at all, what is their speciality?

Roughly speaking, market segments can be divided into outpatient and inpatient target group structures. These can be groupings for the sales (channel) or groupings for decision-makers or users (see illustration).

In-patient Segments

The group of in-patient segments includes hospitals and nursing homes. Depending on the medical device, these can be further subdivided. For a hip prosthesis, for example, the orthopaedic surgeons and the purchasers in the hospitals are the ones who decide on the use of the hip prosthesis. In nursing homes, the nursing service management or even the home management can be important contacts. If specialised dealers are interposed, it is also important to serve them.

Out-patient Segments

The classic out-patient market segments include pharmacies, medical supply stores, medical service centres (MVZ), the entire field of office-based doctors with different specialisations, home nursing services, etc. Depending on the medical device, these customer groups are addressed.

In the case of incontinence care products, for example, the home nursing services are important influencers in the use of pads and diapers by patients. Here, the health insurance funds would conclude contracts with various service providers, such as medical supply stores, pharmacies or homecare companies.

Important Market Segmentation in Germany

The following is an overview of important market segments with their special characteristics.

1. Health Insurance Companies

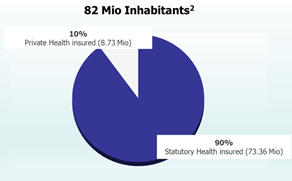

In Germany, almost every German is insured with health insurance, with a few exceptions. 90% of all Germans have statutory health insurance and only 10% have private health insurance.

There are 103 independently operating statutory health insurance funds (as of 2021), which are divided into Local Health Insurance Funds (AOK), Substitute Health Insurance Funds (EK), Guild Health Insurance Funds (IKK) and Company Health Insurance Funds (BKK). Health insurance funds conclude regional or national contracts with the service providers; in special cases also with the manufacturers themselves. Special feature here – the service costs are only reimbursed to the person who also has a contract with the health insurance fund.The medical device manufacturer should take this into account when setting prices, especially for comparable medical devices or mass products.

2. Hospitals

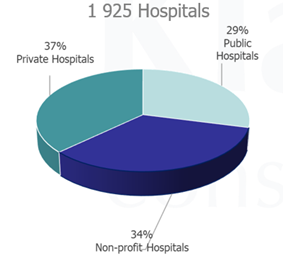

In 2019, according to the Federal Statistical Office, a total of € 98.8 billion was paid for treatments of patients in German hospitals. No wonder that the almost 2,000 hospitals are one of the most important market segments for manufacturers of medical devices. German hospitals belong to 3 different ownerships – these are private, public and non-profit.

It is interesting to note that the public hospitals, which only a portion of 29%, have almost 50% of the total bed capacity of 500,000.

In addition, 90% of all hospitals are members of purchasing cooperatives, e.g. Prospitalia, EK UNICO, Clinicpartner. Many of the private hospitals belong to large groups. The 3 largest include Helios, Asklepios and the Sana Group.

Due to the high density, the central purchasers play an increasingly important role as decision-makers alongside the specialists or nurses in the decision “for” a medical device in the hospital. In this respect, this group of people is an important target group in the overall approach. They are mostly visited by key account managers from the industry.

Manufacturers of innovative medical devices are advised to approach the segment of Key-Opinion Leaders (KOL) before a market launch. KOLs are doctors with extensive specialist training and experience whose expertise is highly regarded in the same professional circles. Only through their advocacy is market success guaranteed.

3. Medical Supply Stores

The 3,000 medical supply stores in Germany play a major role in the sale of medical devices. For a long time, medical supply stores were family-run. An increasing consolidation through acquisitions and mergers has taken place in recent years.

The 3 large groups include: Auxilium GmbH with 82 branches, GHD Gesundheits GmbH with 61 affiliated houses and Alippi with 51 branches (as of 2020).

A large proportion of the medical supply stores have joined various purchasing cooperatives (rehaVital, Sanitätshaus Aktuell, etc.).

Medical supply stores not only sell a wide range of medical aids, but also specialise in rehabilitation and orthopaedic technology, including orthopaedic shoe technology.

Other market segmentation in Germany that should not be ignored in the sale of medical devices are the 19,400 pharmacies, whose turnover with these products accounts for 9% of the total turnover.

Over-the-counter medical products can also be found in drugstores (Rossmann, DM, Müller) or even in supermarkets.

An important decision-maker of medical devices, but also consumer of e.g. medical practice supplies, is the large group of 72,000 physicians in private practice, which can be further subdivided according to different specialties.

Conclusion

The more precisely a medical device manufacturer has defined its market segments, the more clearly and convincingly it can address its customers. This is an important step towards market success.

Read also:

Efficiency increase of the strategic distribution of medical devices in Europe for SMEs