Distribution of Medical Devices to France

French Medical Device Market

April 2020 by Maria Klaas – With 67 million inhabitants, France is the second largest market in Europe after Germany. And this also applies to the Medical Device sector. Therefore, medical device manufacturers from all over the world would like to place their products here as well. But how can a successful market entry take place?

If the forecasts of BMI Research are correct, the market will grow at an average annual rate of 4.7 percent, from EUR 13.5 billion (2018) to EUR 15.5 billion in 2021. The French medical technology association SNITEM (Syndicat National de L’Industrie des Technologies Medicale) even expects sector sales of EUR 28 billion (2016), of which EUR 8 billion will be exported. A look at health expenditure in 2017 shows a share of 11.5% of GDP (Germany 11.3%) (OECD).

Market entry via a strategic sales partner

Apart from larger companies that set up their own subsidiary in France, it is mostly SMEs that want to sell their Medical Devices in France. For them, distribution through a strategic sales partner is advantageous, who should meet the following criteria:

– a manageable number of medical devices

– a sales force covering the whole of France

– existing good contacts to the defined target group

– Willingness to invest in promotion and human resources, if necessary

The following market-relevant information is indispensable for successful market entry:

1. information on the registration of a medical device that is already CE certified

2. guidance on the reimbursement of medical expenses, where the medical device could be covered by the health care reimbursement system

3. knowledge of the exact distribution structure in order to find a suitable distribution partner

Registration of Medical Devices

Medical devices that have a CE mark can be sold in France. However, the product must first be “registered” with the ANSM (Agence Nationale de Sécurité du Médicament et des Produits de Santé). This registration can be done by the manufacturer himself or his French distributor at the ANSM. Important: Registration is always in the name of the manufacturer, even if it is carried out by the distributor.

In addition, a user manual in French is required.

Reimbursement of medical expenses

If the medical devices to be imported are covered by the reimbursement of medical expenses, they must be listed in the LPPR (List des Produits et Prestations Remboursables). This list includes implantable medical devices, bandages, wheelchairs, etc.

Strategic partners offer their support in the LPPR listing.

For innovative medical devices, the manufacturer must submit an application to the CNEDiMTS (La Commission nationale d’évaluation des dispositifs médicaux et des technologies de santé) at the HAS (Haute Autorite de Santé). It makes a recommendation on the therapeutic benefits and added value. The manufacturer must also submit an application for pricing to the CEPS (Comite Economique des Produits de Santé). The decision on inclusion in the LPPR list is the responsibility of the Ministry of Solidarity and Health.

If you do not have the necessary know-how yourself, it is advisable to consult a management consultancy in France.

Distribution structure

The distribution structure for medical devices in France can be roughly divided into two market segments:

(1) Stationary segment: hospitals

(2) Outpatient segment: Pharmacies, Parapharmacies and Homecare segment

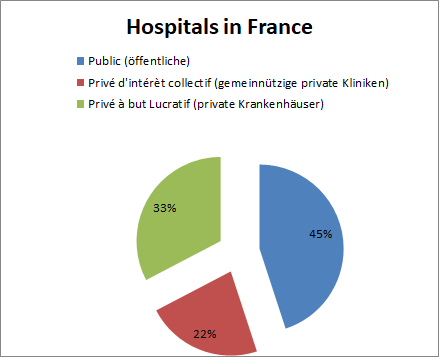

The hospital system in France consists of public and private healthcare institutions.

Of the 3,100 hospitals (source: DREES, 2017), about 1,400 are public institutions (45%) and 1,700 are non-profit private clinics (22%) and private hospitals (33%), the latter category being more likely to be small houses with a smaller number of beds.

Hospitals are increasingly procuring their supplies through purchasing groups. In addition to three large national ECGs (UniHa, Resah and Ugap), there are about 160 regional ones, but they often purchase only a few product groups together (and often no medical technology). By far the largest private hospital group is the Ramsay Générale de Santé Group, which alone owns 50 percent of all hospitals.

Almost all hospital procurement is done through tenders, which can also be found on some websites, such as: www.e-marchespublics.com, www.achat-hopital.com, www.journal-officiel.gouv.fr.

The trend in France is towards more and more outpatient treatments; fewer inpatient operations are to be carried out in the future. Whereas in 2016 54 percent of all operations were still performed on an outpatient basis, this figure is expected to rise to 70 percent in 2022.

Suitable French distribution partners in the hospital sector are well acquainted with tenders. In this respect, these should not constitute a market barrier.

With regard to the outpatient segment, reference should be made to the 21,000 pharmacies and parapharmacies. The latter resemble German drugstores with a total turnover of 3.2 billion euros in 2018 and are often affiliated with supermarket chains. With regard to medical devices that are subject to pharmacy obligations, such as self-tests and blood pressure monitors, there is to be liberalisation. Medical devices will play a more important role in parapharmacies in the future.

The business with homecare articles is worth a separate consideration. Products for the home care of elderly, sick and disabled people can be bought or rented in France in approximately 2,000 specialist shops. The range includes medical and orthopaedic articles. CapVital Santé offers a large national network with 250 independent shops. The Bastide Le Confort Médical has 100 points of sale. Compared to the German medical supply stores, however, the product range is much leaner. The pharmacies are leading in this area.

The classic orthopaedic technicians, as we find them in our own stores in Germany, do not exist in France. Orthopaedic shoes are sold by pharmacies or homecare stores. In France, too, orthopaedic technicians are responsible for the “made-to-measure” production of orthopaedic shoes, with the difference that these are measured by the orthopaedist and later manufactured by the orthopaedic technician in his workshop.

Developments in the future

In the coming years, the government will release investments of 5 billion euros for the digitalisation of the health sector. 3 billion of this is earmarked for the modernisation of technical equipment and infrastructure.

According to the SNITEM association, the social security system will make savings above all in the area of medical devices. In particular, further savings will be made on investments by hospitals. This applies especially to public hospitals, as they account for 77 percent of health expenditure.

All in all, it remains to be seen that the reforms in France will also change the individual distribution structures, especially in the outpatient sector. Medical technology companies should be called upon to monitor this market closely in the coming months and react to changes accordingly. With a suitable strategic partner, market entry should be successful.

Download of total Article in English “Distribution of Medical Devices to France (pdf)”

In German “Vertrieb von Medizinprodukten nach Frankreich”, published in MTD Dialog, April 2020

Are you Looking for a suitable Partner in France, please contact us

Please read also articles:

“Efficiency increase of the strategic distribution of medical devices in Europe for SMEs” or download pdf

“Drastic changes in the pharmacy and parapharmcy sector in France”